aurora sales tax calculator

The December 2020 total local sales tax rate was also 7375. The minimum combined 2021 sales tax rate for East Aurora New York is.

8 25 Sales Tax Calculator Template Tax Printables Sales Tax Tax

There is no county sale tax for Aurora MaineThere is no city sale tax for Aurora.

. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product. The average sales tax rate in Colorado is 6078.

The current total local sales tax rate in Aurora OR is 0000The December 2020 total local sales tax rate was also 0000. How 2021 Q2 Sales taxes are calculated in Aurora. The Aurora Colorado general sales tax rate is 29Depending on the zipcode the sales tax rate of Aurora may vary from 675 to 85 Every 2022 combined rates mentioned above are the results of Colorado state rate 29 the county rate 025 to 075 the Aurora tax rate 25 to 375 and in some case special rate 01.

This is the total of state county and city sales tax rates. This level of accuracy is important when determining sales tax rates. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables.

How 2022 Sales taxes are calculated in Aurora. The Aurora Ohio general sales tax rate is 575The sales tax rate is always 7 Every 2022 combined rates mentioned above are the results of Ohio state rate 575 the county rate 125. The County sales tax rate is.

Aurora collects a 4125 local sales tax the maximum local sales tax allowed under. How 2022 Sales taxes are calculated in Aurora. The New York sales tax rate is currently.

The current total local sales tax rate in Aurora MN is 7375. 101 rows How 2022 Sales taxes are calculated for zip code 80014. There is no city sale tax for Aurora.

The Aurora Maine general sales tax rate is 55The sales tax rate is always 55 Every 2021 Q2 combined rates mentioned above are the results of Maine state rate 55. The Colorado sales tax rate is currently. Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2.

The minimum combined 2021 sales tax rate for Aurora Colorado is. The Aurora sales tax rate is. Method to calculate Aurora sales tax in 2021.

The Aurora Missouri sales tax is 835 consisting of 423 Missouri state sales tax and 413 Aurora local sales taxesThe local sales tax consists of a 163 county sales tax and a 250 city sales tax. Business Licensing and Tax Class Aurora offers a free workshop designed to help new and existing businesses understand business licensing and taxes. A spreadsheet is provided as an example for how to document transactions and calculate use tax liability.

Aurora OR Sales Tax Rate. Wayfair Inc affect Colorado. This is the total of state county and city sales tax rates.

While many other states allow counties and other localities to collect a local option sales tax Illinois does not permit local sales taxes to be collected. When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction. The sales tax vendor collection allowance is eliminated with the January filing period due February 20 2018.

The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. The current total local sales tax rate in Aurora IN is 7000. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

Did South Dakota v. The sales tax rate for Aurora was updated for the 2020 tax year this is the current sales tax rate we are using in the Aurora South Dakota Sales Tax Comparison Calculator for 202223. What is the sales tax rate in East Aurora New York.

The East Aurora sales tax rate is. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Angie will report the use tax online 10 of their Aurora Sales and Use Tax return.

The December 2020 total local sales tax rate was also 7000. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. The County sales tax rate is.

The North Aurora Illinois sales tax is 625 the same as the Illinois state sales tax. If this rate has been updated locally please contact us and we. Did South Dakota v.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Taxpayers can use a spreadsheet like this example to upload when filing tax returns online or it can be included with a paper return. The North Aurora Sales Tax is collected by the merchant on all qualifying sales made within North Aurora.

Property Tax Village Of Carol Stream Il

Aurora Colorado Sales Tax Rate Sales Taxes By City

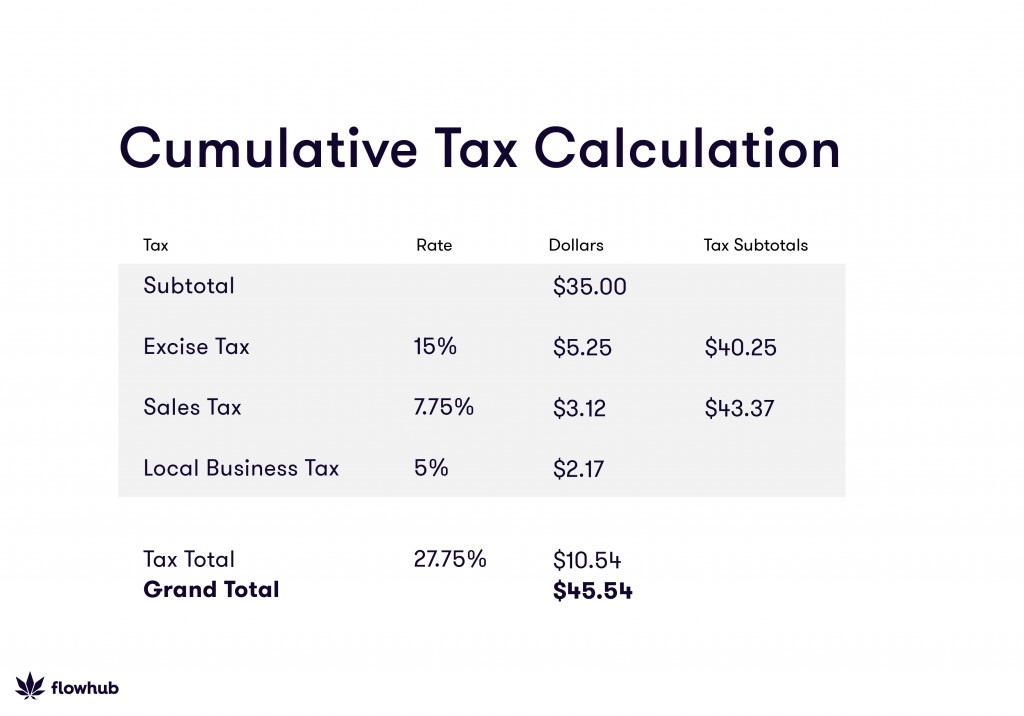

How To Calculate Cannabis Taxes At Your Dispensary

Illinois Car Sales Tax Countryside Autobarn Volkswagen

How To Calculate Sales Tax Sales Tax Tax Sales And Marketing

How Colorado Taxes Work Auto Dealers Dealr Tax

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource